27+ mortgage payment to income

Compare Loans Calculate Payments - All Online. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

The Percentage Of Income Rule For Mortgages Rocket Money

The limit used to be 1 million but that changed after the passage of the.

. 5000 x 028 1400 total monthly mortgage payment PITI Joes total monthly mortgage payments including. The borrower agrees to pay back the loan. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

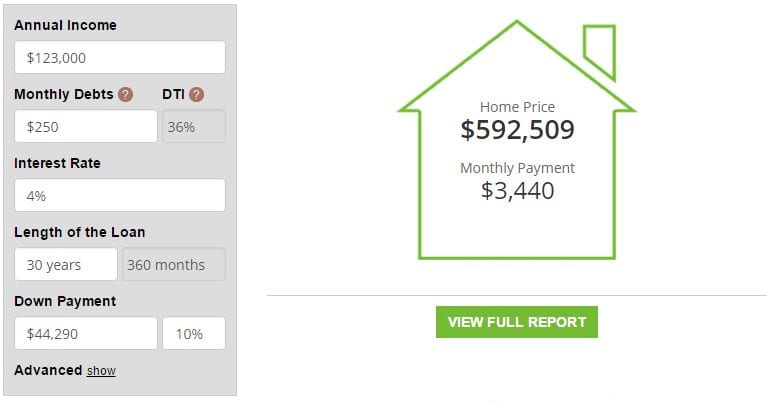

Ad See how much house you can afford. National Average Fixed Source. Compare Loans Calculate Payments - All Online.

Calculating your monthly payment range typically gives you a good goal to reach for when car shopping. Scroll down the page for more. Web A mortgage payment on an average-price home with a standard 20 down payment 30-year mortgage now adds up to 31 of the median American households income.

Find your monthly gross income by reviewing your. Web How Much Mortgage Can I Afford. Ad Check How Much Home Loan You Can Afford.

Web First take your pre-tax monthly income and multiple it by 015 then repeat the process multiplying by 020. Ad Calculate Your Payment with 0 Down. Web Most home loans require a down payment of at least 3.

Web If you are married filing separately you can only deduct mortgage interest if the mortgage debt is 375000 or less. Advantages and Disadvantages of Mortgage Payable. Web Thats a gross monthly income of 5000 a month.

This rule says that you should not spend more than 28 of your gross income on your mortgage payment. Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Check Your Official Eligibility.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Likewise in this journal entry the mortgage liability in the balance sheet decreases debit by 10500 while the expense in the income statement increases debit by 4500 for the interest on mortgage payments. Estimate your monthly mortgage payment.

Gross income is your income before any deductions or taxes are taken out. Ad Take the First Step Towards Your Dream Home See If You Qualify. Web Graph and download economic data for Mortgage Debt Service Payments as a Percent of Disposable Personal Income MDSP from Q1 1980 to Q3 2022 about payments disposable mortgage personal income debt percent personal services income and USA.

To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income. Web In general you shouldnt pay more than 28 of your income to a house payment though you may be approved with a higher percentage. The totals represent your high and low monthly payment amounts.

Web It is a type of secured loan which means that the house or real estate property itself is used as collateral against the loan. Web The total payment of 15000 is for both principal and interest of mortgage payable. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the.

Generally speaking most prospective homeowners can afford to finance a property whose mortgage isbetween two and two. Web Mortgage Calculator Latest Mortgage Rates. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your. Updated FHA Loan Requirements for 2023. Ad Check How Much Home Loan You Can Afford.

24 2023 30 Years. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Web The 28 rule refers to your mortgage-to-income ratio.

Mpgb Madhya Pradesh Gramin Bank

Net Income Formula Calculator With Excel Template

27 Free Editable Personal Budget Templates In Ms Word Doc Pdffiller

Personal Income What Are The Methods To Calculate Personal Income

Soft Loan How Does Soft Loan Work With Examples

Mortgage Calculator Pmi Interest Taxes And Insurance

Lauren Patterson Salt Lake City Metropolitan Area Professional Profile Linkedin

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

27 Sample Home Budgets In Pdf Ms Word

27 Affordable Care Act Statistics And Facts Policy Advice Policy Advice

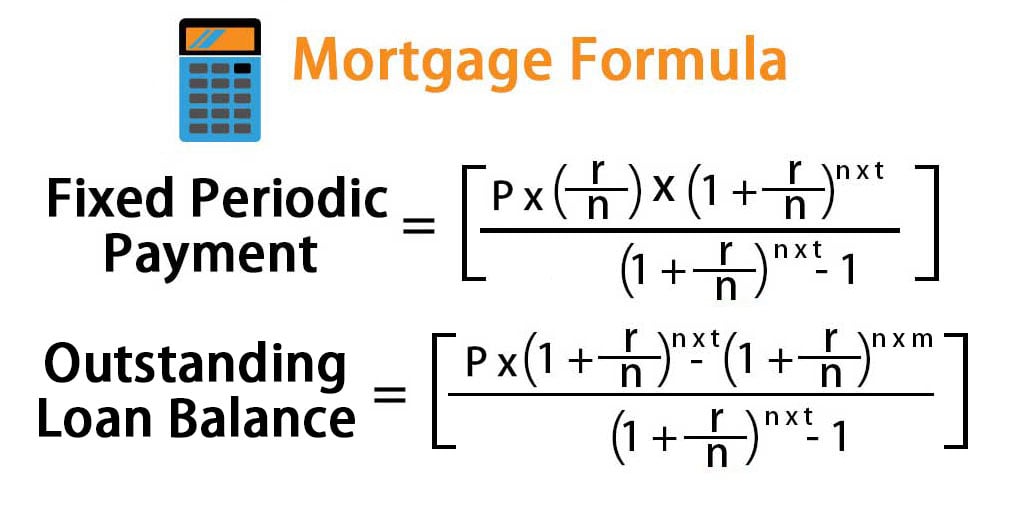

Mortgage Formula Examples With Excel Template

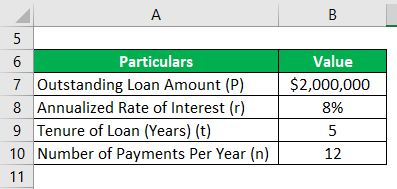

Interest Expense Formula Calculator Excel Template

Jul 20 Free Home Buying 101 Webinar Philadelphia Pa Patch

Mortgage Formula Examples With Excel Template

Rgv New Homes Guide Issue 30 Vol 4 November December 2022 January 2023 By New Homes South Texas Issuu

How Much To Spend On A Mortgage Based On Salary Experian

Average Monthly Mortgage Payments Valuepenguin